Accessibility menu

Access Finance Launches AI-Powered Chatbot to Enhance Customer Experience

Revolutionising Customer Service with Automation and AI

We’re excited to launch our new AI Chatbot, which will provide 24/7 real-time support. This is a big step in our journey to transform customer service through digital technology.

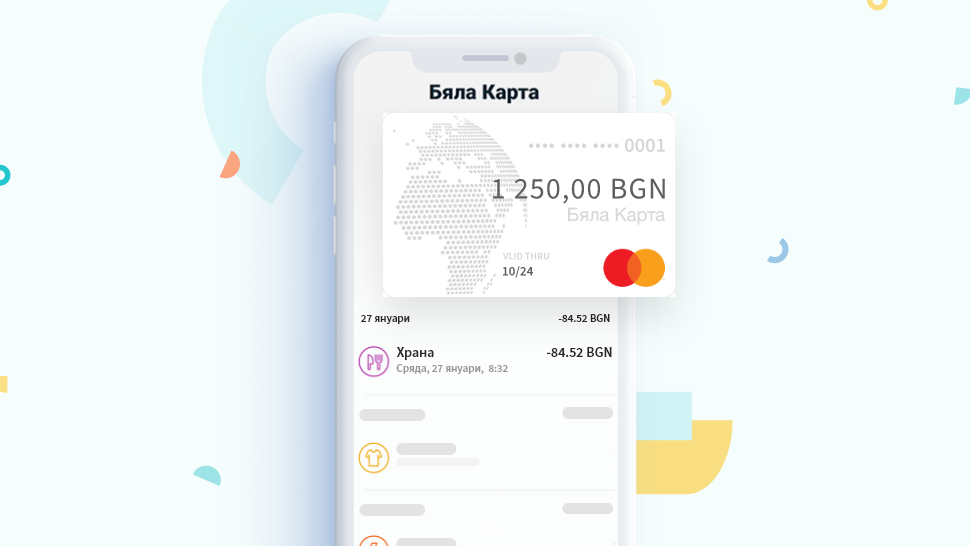

The Chatbot can answer your questions instantly about services like credit limit increases, account balance checks, transaction details, and card usage guidance. By automating these common requests, the Chatbot means no more waiting, and you can get the support you need whenever and wherever.

A year in the making

The Chatbot has been in development for a year, requiring intensive research, testing, and integration into our systems. We prioritize customer needs to deliver a scalable, reliable, and user-friendly solution.

“We didn’t just want to build a Chatbot,” said Velko Kamenov, CRO at Access Finance. “We wanted to create a solution that addresses our customers’ most common pain points and frees our agents to deal with more complex queries. This is a game changer for customer satisfaction and operational efficiency.”

Innovation Overcome

Access Finance didn’t shy away from the complexity of building this technology. The project involved:

- Mastering Kubernetes clusters.

- Building advanced API interfaces.

- Using real-time data processing with Redis.

- Real-time system monitoring with Grafana.

One of the biggest challenges was training the Chatbot’s Large Language Model (LLM) to work within a controlled environment. After thorough testing and optimization, the Chatbot has been perfect since day one.

Customer feedback

The impact is already visible:

📱 Available in the Access Finance mobile app for Android now.

⏱ Within 24 hours, over 100 customers have already got credit limit increases, a process that took 2 days.

🌟 Customers no longer need to call support for standard queries get answers instantly in the app.

“Customer feedback has been great,” said Zheko Staykov, Head of Operations at Access Finance. “They love the convenience and speed.”

Next up

Access Finance is already working on the next phase:

🚀 Automated real-time credit limit increases, currently one business day.

🌍 Rolling out the Chatbot to Romania and Spain to cover all European markets.

This innovation is part of Access Finance’s overall approach to process automation and digital services. We’re setting a new benchmark in financial technology and customer experience using AI.

About Access Finance

Access Finance is a financial technology company that’s all about innovation and customer service. By going digital and using AI, we’re changing the economic experience for customers across Europe.

0 Comments

Subscribe

Stay Ahead of the Financial Curve!

Subscribe to Our Newsletter for Exclusive Insights, Expert Tips, and Exciting Opportunities.